Yesterday, Friday 29th May, the Chancellor, Rishi Sunak announced changes to both the Coronavirus Job Retention Scheme (CJRS) and the Self-Employment Income Support Scheme (SEISS):

Coronavirus Job Retention Scheme

The scheme is set to end in it’s present form at the end of October. The following changes/ extensions have been announced:

- From 1 July, employers can bring back to work employees that have previously been furloughed for any amount of time and any shift pattern, while still being able to claim CJRS grant for their normal hours not worked. When claiming the CJRS grant for furloughed hours employers will need to report and claim for a minimum period of a week.

- The scheme will close to new entrants from 30th June. From this point onwards, employers will only be able to furlough employees that they have furloughed for a full 3 week period prior to 30th June, i.e. they must be furloughed for the first time by 10th June.

- Further guidance on flexible furloughing and how employers should calculate claims will be published by HMRC on 12 June.

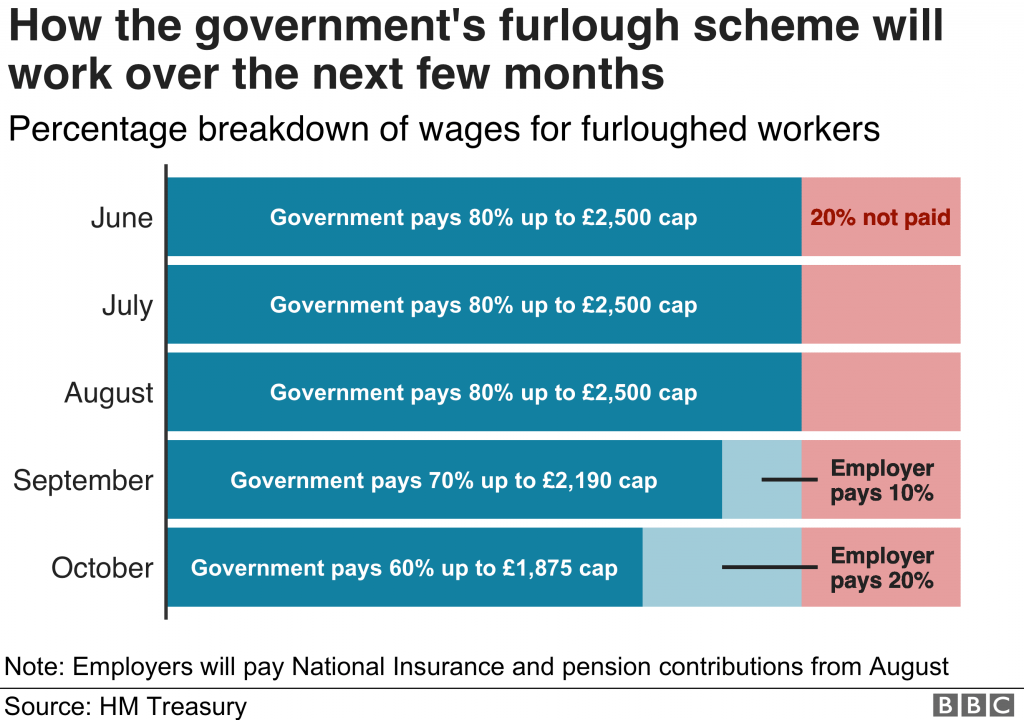

- The scheme continues as at present until the end of July, i.e. the government pays 80% of the furloughed wages (up to the cap of £2,500) including employers national insurance contributions (ER NICS) and employers pension contributions (ER PCS) with the employer not having to contribute.

- In August the government continues to pay 80% of wages up to the £2,500 cap although the employer will pay the ER NICS and ER PCS. For many small businesses the NIC Allowance of £4,000 will continue to cover the ER NICS.

- In September the government will pay 70% of wages up to a cap of £1,875. The employer will pay 10% to make up to 80% (the £2,500 cap remains). The employer continues to pay the ER NICS and ER PCS.

- In October the government will pay 60% of wages up to a cap of £2,187.50. The employer will pay 20% to make up to 80% (the £2,500 cap remains). The employer continues to pay the ER NICS and ER PCS.

- Employers will be required to submit data on the usual hours an employee would be expected to work in a claim period and actual hours worked.

The BBC has produced the following graphic to illustrate the contributions split:

Self-Employment Income Support Scheme

A second grant has been announced to further help those whom are self-employed:

- People can still apply for the first SEISS grant until 13th July. Under this grant eligible individuals can claim a taxable grant worth 80% of their average monthly trading profits. This is paid in a single installment covering 3 months worth of profits up to £7,500 in total.

- In August individuals will be able to claim for a second grant. This time the grant will cover 70% of their average monthly profits. Again, this is paid in a single installment covering 3 months worth of profits up to £6,750 in total.

- The elgibility criteria are the same for both grants. People will need to confirm that their business has been adversely affected by Coronavirus.

- You do not have had to claim the first grant to claim the second. You may have only been affected at a later date.

- Again, further guidance will be publised by HMRC on 12th June.

Further details can be found here:

and here:

https://www.gov.uk/guidance/claim-for-wages-through-the-coronavirus-job-retention-scheme#history

These extensions are welcome, although the tapering of support shows the government intention that the supporting of business is not going to continue indefinitley. However, it is a long way to the end of October and a lot can happen in that time.

Hopefully things will be returning more towards normal (what that will look like is unsure at the moment) by then and business revenues will pick up.