Pension notes

Limited companies can use company pensions or workplace pensions such as NEST. Stuart Clegg Associates Ltd are not pensions advisors and so you should get independent advice on company pensions.

There is tax relief on the employee’s contributions.

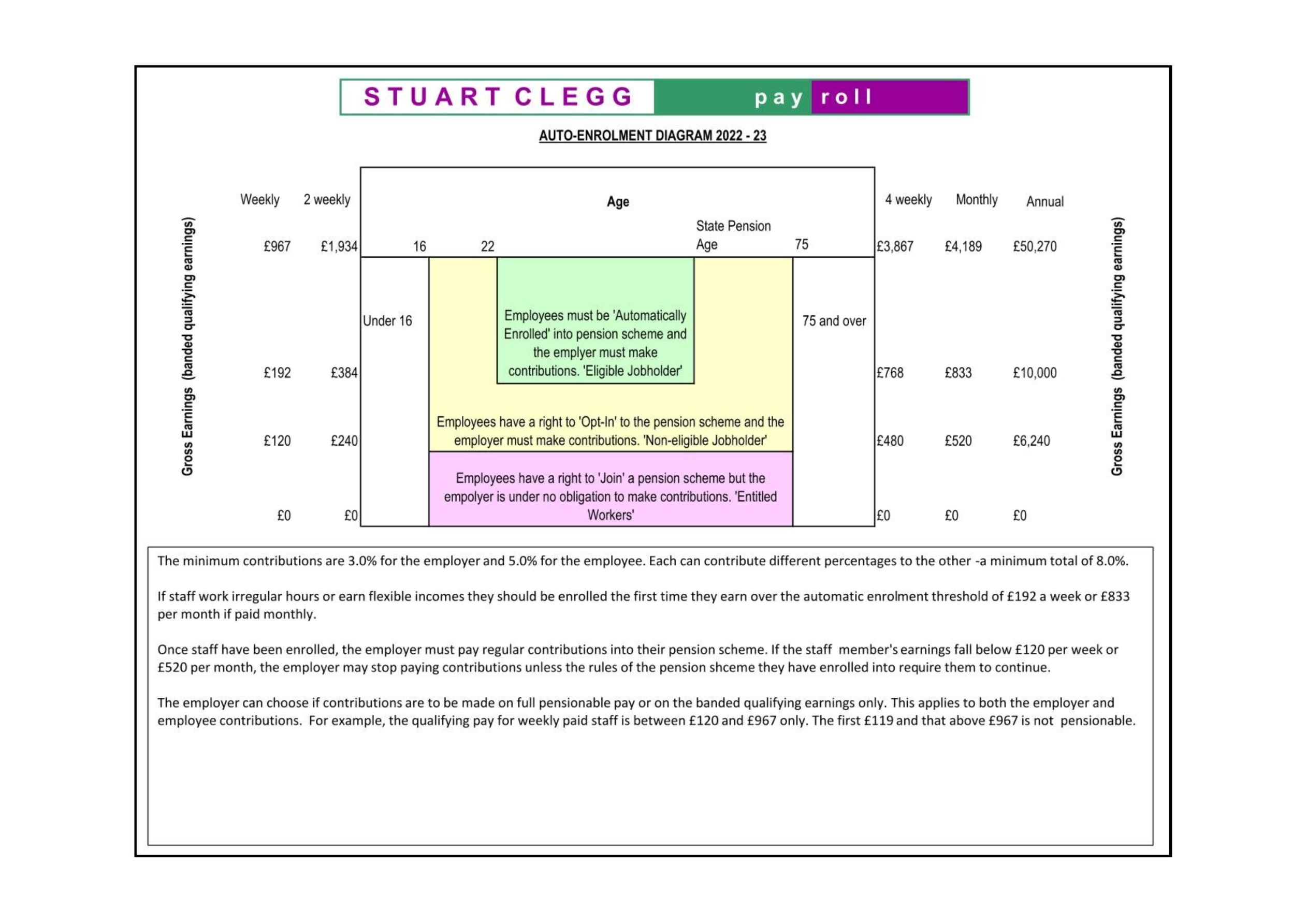

Auto-enrolment occurs when someone is between 16 and the state pension age and earns more than £10,000 per annum. Employees can opt out. They can also opt in or ask to join if their earnings are below this.

The minimum contributions are 3.0% for the employer and 5.0% for the employee. Each can contribute different percentages to the other -a minimum total of 8.0%.

If staff work irregular hours or earn flexible incomes they should be enrolled the first time they earn over the automatic enrolment threshold of £192 a week or £833 per month if paid monthly (£10,000 pa).

Once staff have been enrolled, the employer must pay regular contributions into their pension scheme. If the staff member's earnings fall below £120 per week or £520 per month, the employer may stop paying contributions unless the rules of the pension scheme they have enrolled into require them to continue.

The employer can choose if contributions are to be made on full pensionable pay or on the banded qualifying earnings only. This applies to both the employer and employee contributions. For example, the qualifying pay for weekly paid staff is between £120 and £967 only. The first £119 and that above £967 is not pensionable. To minimise expense banded earnings can be used. To maximise contributions full pensionable pay (and/ or higher percentages) can be used.

There two forms of workplace pension ‘Relief at Source’ and ‘Net Pay Arrangement’. They differ in how the tax relief is applied. An important thing to note is that if the person is a non-taxpayer then tax relief is only available on ‘relief at source’ pensions such as NEST, not on the ‘net pay arrangement’ types.

If the employee is in the higher tax bracket then the net pay arrangement will calculate the full tax relief. The relief at source type only allows for 20% relief and the additional relief has to be claimed through Self-Assessment.

For a limited company the pension is a business expense and so is deducted before corporation tax is calculated.

Go to the Workplace pension page.